Alternative to VA Small Business Loans

There are many benefits afforded to military members past and present but sometimes navigating through them can be a monumental task. Identifying which ones that you qualify for and how to apply can and will prove daunting. Today we are going to addr

Alternative to VA Small Business Loans

by himolekuConfused About VA Small Business Loans?

There are many benefits afforded to military members past and present but sometimes navigating through them can be a monumental task. Identifying which ones that you qualify for and how to apply can and will prove daunting. Today we are going to address small business loans that are available to veterans and how to apply for them.

Know What’s Available to You

There two types of loans that are available which are the Patriot Express Pilot Loan Initiative and the Military Reservist Economic Injury Disaster Loan or MREIDL. Regardless of which one you choose or qualify for, it is important to understand that they are not actually private student loans provided from the Veterans Affairs (VA) Administration or Small Business Administration (SBA). In actuality they are a guarantee provided from the VA and SBA to reputable private lenders.

How to Apply

The first step in applying for VA Small Business Loan is to identify which one of the two loan types you qualify for. If you are a reservist who has been called to active duty then you will be applying for the MREIDL, everyone else will be applying to the Patriot Express Pilot Loan Initiative which we will be looking at first.

The Patriot Express Pilot Initiative was set to expire in 2010 but its rate of success extended the benefit through 2013. There is no guarantee that this service will be provided in the following year. There are also options for spouses and widows to take advantage of this type of loan if they are interested in starting a small business. Applying can be as simple as finding out if you are qualified and filling out the appropriate paperwork. If you have been discharged other than honorably or less, you do not qualify for this loan. Keep in mind that the loan is provided from a bank or financial institution, not from the VA or SBA.

The Military Reservist Economic Injury Disaster Loan or (MREIDL) is an excellent benefit offered to reservists who are currently small business owners. It often becomes difficult for a reservist to live a normal life and care for their business if the threat of sudden deployment is lurking right around the corner. Fortunately, the government understands the financial hardship that this causes. This loan does not end the day you return from deployment either, it continues for up to one year after the member is released from active duty to ensure that they recover from any financial loss. In order to qualify for this loan you must currently be a reservist and already own a small business. Evidence showing the need for this loan will be required and if it is found that the individual has the necessary funds to provide for their own recovery, the us of a MREIDL may not be approved.

Final Thoughts

Which ever loan is chosen, they are both great benefits afforded to our military and military spouses.

Similar posts

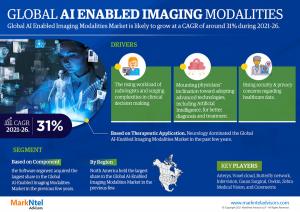

AI Enabled Imaging Modalities Market By Manufacturers, Development Strategy, Upcoming Trends and Huge Growth By 2026

by azhar

The research study given in this report provides a thorough and insightful examination of the AI Enabled Imaging Modalities Market including its competitiveness, segmentation, dynamics, and geographic progression.

- Jun, 22 2022

- Experimental

Across the Tide

by sheelsdevi

A story inspired by a true life incident

- Nov, 18 2016

- Experimental Realistic Fiction

Question Policy

by ILLPolicy

What is policy? It’s what you are told to do, by someone of authority, in a specific situation.

- Apr, 10 2016

- Experimental Poetic

From Life's Complications

by Surinam27

Man's life can of often like a hell and it is difficult to reach safety. Only faith in the Almighty will help us find the path to eternal peace and satisfaction.

- Jul, 23 2019

- Experimental

Mushroom Chocolate Bar Packaging for Smart.

by Linkbuilderblog

With smart packaging, functionality, aesthetics and eco friendliness are all combined to elevate the experience, smart packaging is the future of chocolate bar branding.

- Dec, 26 2024

- Experimental

1 COMMENTS

powerboat

June 20, 2018 - 11:52 It's depending on what is load to your small business, more on https://bible.org/users/grals. I have a coffee shop around the city's railway stations and I'm happy. Good luck to beginners